How I Beat the Debt Game Without Losing My Mind

Dealing with debt used to keep me up at night—endless payments, surprise fees, and that constant stress. I tried quick fixes that made things worse. But after testing real strategies, I found a path that actually works. This is how I took control, protected myself from risks, and started breathing again—no magic tricks, just smart moves worth sharing. It wasn’t about earning more or cutting every luxury. It was about changing how I saw debt, money, and risk. The shift didn’t happen overnight, but it was lasting. What follows is not a theoretical guide pulled from a textbook, but a real journey through confusion, fear, and eventually clarity. If you’ve ever felt trapped by bills, misunderstood by financial advice, or overwhelmed by the pressure to ‘just pay it off,’ this is for you. Because the truth is, getting out of debt isn’t just about numbers. It’s about building a system that respects your reality, protects your peace, and lasts beyond the final payment.

The Moment Everything Clicked

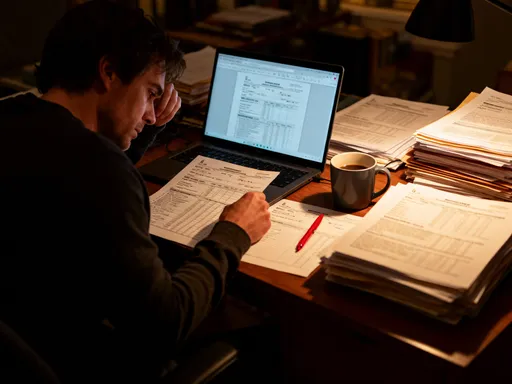

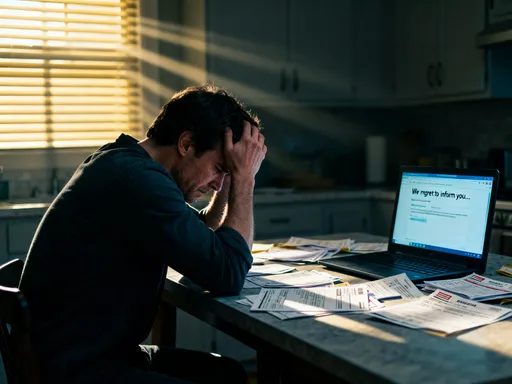

There was a month when everything seemed to collapse at once. A car repair drained my emergency fund, a medical co-pay arrived unannounced, and then the credit card minimum payment jumped without warning. I remember sitting at my kitchen table, receipts spread out, calculator in hand, realizing I didn’t have enough to cover even the basics. That was the moment I stopped seeing debt as a personal failure and started seeing it as a system failure. I had been following the rules—making payments on time, avoiding new charges—but I still felt powerless. The emotional toll was just as heavy as the financial one. I felt shame when I opened statements, anxiety every time the phone rang, and a constant low-grade fear that one more surprise would break me completely.

What changed wasn’t a windfall or a new job. It was a shift in perspective. I began to ask different questions: Why did my payments keep increasing? Why did ‘on-time’ payments still leave me behind? Why did every plan assume perfect income and no emergencies? I realized I wasn’t bad with money—I was using tools that weren’t designed for real life. Most debt advice assumes stability, but real households face fluctuations. A child gets sick. A shift gets cut. A pipe bursts. When your repayment plan can’t absorb those shocks, it fails—not because you lack discipline, but because the plan lacks resilience. That realization freed me. It wasn’t about trying harder; it was about building smarter. I stopped chasing perfection and started designing for protection.

This mental shift was the foundation of everything that followed. I stopped measuring success by how fast I could eliminate a balance and started measuring it by how secure I felt. Peace of mind became the goal, not just payoff speed. I began to treat financial health like physical health—something that required prevention, not just treatment. Just as you wouldn’t ignore a recurring pain, I couldn’t ignore the patterns that kept me vulnerable. I needed a strategy that accounted for risk, not one that pretended it didn’t exist. That meant redefining what ‘responsible’ money management really meant. It wasn’t about austerity or punishment. It was about creating a structure that could hold up when life got messy. And that started with understanding the real enemy.

Understanding the Real Enemy: Risk in Repayment

Most debt advice focuses on interest rates and payoff speed, but few address the silent killer: financial risk. The real danger isn’t just paying interest—it’s the chance that a small setback will trigger a full collapse. I learned this the hard way when I followed a strict snowball method for six months, only to have a family emergency force me to skip payments. One missed due date led to late fees, which pushed my next month’s budget over the edge, which meant using another card to cover groceries. In three weeks, I was back where I started. The method itself wasn’t flawed, but it assumed no interruptions. It had no margin for error, and that made it fragile.

Risk in repayment comes in many forms. Income volatility is one of the biggest. For many households, especially those relying on hourly wages or seasonal work, income isn’t a steady line—it’s a wave. A repayment plan built on a fixed monthly amount can work in good months but fail completely in lean ones. Then there’s unexpected expenses. No matter how careful you are, life brings costs you can’t predict: a tire blowout, a pet’s illness, a sudden move. If your entire budget is allocated to debt, there’s no room to absorb these without borrowing more. That’s not poor discipline—that’s poor design.

Another hidden risk is psychological burnout. Aggressive payoff plans often require extreme cuts to spending, which can be unsustainable. When you’re told to eliminate all ‘wants,’ you set yourself up for guilt and failure the moment you buy coffee or treat your child to a movie. These small lapses don’t ruin progress, but the shame they bring can derail motivation. And that’s where many people quit. They don’t fail because they’re irresponsible—they fail because the plan didn’t account for human behavior. A strategy that ignores emotional sustainability is just as risky as one that ignores cash flow.

The cost of ignoring these risks is high. Late fees, credit score damage, and the need to take on new debt are common outcomes. But the deeper cost is loss of confidence. Every time a plan fails, you start to believe you can’t do it. You feel trapped. That’s why the first step in beating debt isn’t a calculator—it’s a risk assessment. Before you decide how to pay, you need to ask: What could go wrong? How much buffer do I need? What happens if I miss a payment? Building a strategy that answers these questions doesn’t slow you down—it protects your progress. Because the goal isn’t just to pay off debt. It’s to do it in a way that doesn’t leave you vulnerable to starting over.

Building a Safety-First Repayment Strategy

Once I understood the risks, I redesigned my approach from the ground up. The core principle was simple: protect stability first, then accelerate payoff. That meant accepting that progress wouldn’t be linear. Instead of committing to a fixed monthly payment I might not always afford, I created a flexible tiered system. I set a minimum payment for each debt—the lowest amount that would avoid late fees and keep the account in good standing. Then I set a target payment—the amount I’d aim for in a typical month. Finally, I set a stretch goal for months when income was higher. This gave me room to adapt without feeling like I’d failed.

A key part of this strategy was rebuilding my emergency buffer, even while paying debt. Conventional wisdom says to focus entirely on debt first, but I found that leaving myself exposed to surprises was too dangerous. So I started small—just $10 per week into a separate savings account. It wasn’t much, but it created psychological relief. Knowing I had even a tiny cushion made me less likely to panic and use credit when something small came up. Over time, as debts were paid off, I redirected those payments into the buffer until I reached a three-month expense target. This didn’t delay my payoff as much as I feared. In fact, it made it more sustainable because I avoided new debt from emergencies.

Another element was debt prioritization with flexibility. I used a modified avalanche method, focusing on high-interest debts first, but I allowed myself to pause and redirect funds if a low-interest debt had a small balance. Knocking out a small balance gave me momentum and freed up cash flow faster. I also negotiated with creditors to lower interest rates and freeze fees where possible. Many people don’t realize that simple calls to customer service can lead to real relief. I wasn’t asking for forgiveness—I was asking for fair terms. And in several cases, I got them.

This safety-first approach changed my relationship with money. I stopped feeling like I was walking a tightrope. Instead, I felt like I was building a foundation. Every payment wasn’t just reducing a balance—it was reinforcing my ability to handle whatever came next. I wasn’t sacrificing security for speed. I was using stability to create long-term progress. That shift made the difference between a plan that lasted and one that collapsed under pressure.

Why One-Size-Fits-All Plans Fail

The financial world loves simple solutions. Pay the minimum on everything except the smallest balance. Attack the highest interest rate first. Consolidate with a loan. These methods are widely promoted because they’re easy to explain. But they often fail in real life because they ignore individual circumstances. I tried both the snowball and avalanche methods, and both failed me—not because they’re bad in theory, but because they didn’t fit my reality. I was working irregular hours, supporting aging parents, and managing childcare. A rigid plan that required a fixed monthly amount was bound to break.

The snowball method, which focuses on paying off the smallest balances first, can build psychological momentum. That’s valuable. But it can also cost more in interest over time, especially if high-interest debts are ignored. I tried it and felt good knocking out a $200 medical bill, but my credit card balance kept growing because I wasn’t paying enough to cover the interest. The avalanche method, which targets high-interest debt first, is mathematically optimal. But it can feel slow and discouraging if your smallest debts take years to clear. I lost motivation because I never saw a balance hit zero, and that made me doubt I was making progress.

What both methods missed was cash flow variability and emotional sustainability. A plan that works for someone with a stable salary may fail for someone with fluctuating income. A strategy that feels motivating to one person may feel punishing to another. I learned that my risk tolerance mattered. I couldn’t handle the stress of a large balance looming for years, even if it saved me money. I needed small wins to stay engaged. At the same time, I couldn’t ignore high-interest debt. So I created a hybrid approach: I focused on high-interest debts but allowed myself to pause and clear small balances when they were within reach. This wasn’t textbook, but it worked for me.

The lesson wasn’t that popular methods are wrong. It was that they should be tools, not rules. A carpenter doesn’t use the same tool for every job. Why should we use the same debt strategy for every life? Your income pattern, family needs, emotional triggers, and risk tolerance should shape your plan. A strategy that respects your reality is more likely to succeed than one that demands you change who you are. Flexibility isn’t weakness—it’s wisdom. And wisdom, not rigidity, is what leads to lasting results.

Tools That Actually Help (Without the Hype)

In my search for solutions, I tried dozens of apps, spreadsheets, and budgeting tools. Many promised miracles but delivered frustration. Some were too complex, others too simplistic. The ones that actually helped shared a few traits: they were simple, adaptable, and transparent. I didn’t need flashy dashboards—I needed clarity. The most useful tool I found was a basic spreadsheet I customized myself. It tracked my balances, interest rates, minimum payments, and progress over time. I updated it monthly, and it gave me a clear picture of where I stood without hiding behind algorithms.

I also used a few trusted apps to automate bill payments and monitor due dates. Automation was a game-changer for consistency. I set up auto-pay for minimum amounts on all debts, which eliminated late fees and reduced mental load. But I didn’t rely on it blindly. I reviewed every transaction, every interest charge, every change in terms. Automation is powerful, but it can’t think for you. I once discovered a creditor had increased my rate without proper notice. Because I was monitoring closely, I caught it and got it reversed. If I’d just assumed the system was working, I’d have paid hundreds extra.

Another helpful feature was alerts for upcoming payments and low balances. These small notifications kept me aware without requiring constant checking. But I avoided tools that promised to ‘optimize’ my payments automatically. These often made decisions based on incomplete data and didn’t account for my priorities. For example, one app suggested putting extra money toward a low-interest loan while I was struggling with a high-interest card. It followed a rule, but it didn’t understand my stress. I needed control, not delegation.

The best tools didn’t replace judgment—they supported it. They gave me data, not decisions. They helped me see patterns, avoid mistakes, and stay consistent. But they didn’t relieve me of responsibility. Technology is a helper, not a hero. When used wisely, it reduces errors and saves time. But when over-relied upon, it creates false security. The real power wasn’t in the tool—it was in my ability to use it with intention. That’s what made the difference between managing debt and being managed by it.

The Psychology of Staying on Track

One of the biggest obstacles to debt repayment isn’t money—it’s emotion. Guilt, shame, and frustration can erode motivation faster than any interest rate. I used to beat myself up for past choices, which made me avoid looking at statements or budgeting altogether. That avoidance only made things worse. I learned that healing the emotional side was just as important as balancing the numbers. I started by reframing my story. Instead of seeing debt as a moral failure, I saw it as a challenge I was learning to navigate. That small shift reduced the shame and made me more willing to engage.

Celebrating small wins was another key. When I paid off a small balance, I acknowledged it—not with a spending splurge, but with a moment of recognition. I’d write it in my journal or tell a trusted friend. These moments built confidence. They reminded me I was capable, that progress was possible. Over time, that confidence reduced emotional spending. I wasn’t shopping to feel better—I was managing money to feel in control. That changed my relationship with purchases. I became more intentional, less impulsive.

I also learned to manage expectations. I stopped promising myself I’d be ‘debt-free in a year’ and started focusing on consistent effort. When I had a setback, I didn’t abandon the plan. I adjusted it. That flexibility prevented the all-or-nothing thinking that had derailed me before. I treated setbacks as data, not failure. Each one taught me something about my limits, my triggers, or my system. That mindset shift—from perfection to progress—was transformative.

Finally, I found strength in routine. The act of reviewing my budget, updating my spreadsheet, and making payments became a ritual of control. It wasn’t exciting, but it was empowering. It reminded me that I was the one in charge. Over time, the anxiety faded. I slept better. I worried less. The numbers improved, but the real victory was internal. I had rebuilt my sense of agency. And that, more than any zero balance, was the foundation of lasting financial health.

From Survival to Strength: Turning Debt Relief into Growth

When I made my final debt payment, I didn’t feel the wild celebration I’d imagined. I felt quiet relief. A deep, steady calm. The real change had happened long before that moment. It was in the months when I handled emergencies without panic, when I stuck to my plan without shame, when I started believing I could build a better future. Paying off debt wasn’t the end—it was the beginning of a new phase. For the first time in years, I had breathing room. And I used it wisely.

I didn’t jump into investing or big purchases. First, I solidified my foundation. I built a full emergency fund, improved my insurance coverage, and started tracking my net worth. These steps weren’t glamorous, but they created security. Only then did I begin to explore low-risk investment options, like index funds and retirement accounts. I started small, with automatic contributions I could afford. The habits I’d developed during debt repayment—consistency, monitoring, flexibility—served me well in investing. I wasn’t chasing quick gains. I was building steady growth.

The experience transformed my entire financial mindset. I no longer saw money as something to fear or control obsessively. I saw it as a tool for stability and choice. I became more generous—not just with others, but with myself. I allowed for reasonable enjoyment without guilt. I planned for vacations, home improvements, and family gifts, knowing I could afford them. That balance—between responsibility and living well—was what I’d been missing.

Looking back, I realize the journey wasn’t just about debt. It was about resilience. It taught me that financial health isn’t about perfection. It’s about preparation, patience, and self-compassion. It’s about building systems that protect you when life doesn’t go as planned. And it’s about finding peace—not just in a zero balance, but in the knowledge that you can handle whatever comes next. That’s the real win. That’s the freedom worth fighting for.