How I Navigated the Investment Cycle to Grow My Kid’s Education Fund — Real Tips That Worked

By Grace Cox / Dec 29, 2025

What I Learned About Retirement Investing When the Market Shifted

By George Bailey / Dec 29, 2025

How I Survived a Debt Crisis Using Smarter Tax Moves

By Emily Johnson / Dec 29, 2025

How I Structured My Family Trust to Protect Returns—And What You Can Learn

By Benjamin Evans / Dec 29, 2025

How I Turned Language Training into a Tax-Smart Move

By Thomas Roberts / Dec 29, 2025

How I Built My Emergency Fund Without Killing My Wallet — Beginner Investment Moves That Actually Work

By Olivia Reed / Dec 29, 2025

How I Upgraded My Portfolio for Serious Growth — No Hype, Just Strategy

By Sarah Davis / Dec 29, 2025

How I Protect My Investments — Legal Smarts Every Investor Needs

By Rebecca Stewart / Dec 29, 2025

How I Navigated Inheritance Planning Without Messing Up the Money

By Olivia Reed / Dec 29, 2025

How I Turned My Debt Into a Wealth-Builder – The Method That Actually Works

By Thomas Roberts / Dec 29, 2025

Why Property Insurance Is Smarter Than You Think—An Expert’s Forecast

By Benjamin Evans / Dec 29, 2025

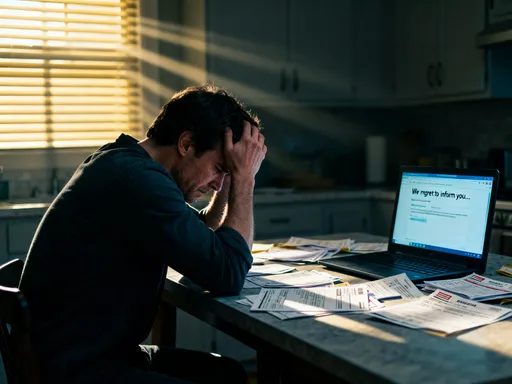

What I Wish I Knew Before Losing My Job: Avoiding Financial Traps

By George Bailey / Dec 29, 2025

How I Mastered Investment Timing Without Guessing the Market

By Grace Cox / Dec 29, 2025

How I Boosted My Returns Without Losing Sleep—A Pro’s Real Talk

By Sophia Lewis / Dec 29, 2025

How I Nailed Tax Compliance While Crushing My Financial Goals

By Emma Thompson / Dec 29, 2025

How I Read the Market’s Mood to Protect My Goals

By David Anderson / Dec 29, 2025

How I Built a Retirement That Pays Me Back — Without the Stress

By Amanda Phillips / Dec 29, 2025

How I Beat the Debt Game Without Losing My Mind

By Benjamin Evans / Dec 29, 2025

How I Turn My Hobbies Into Smart Investments Without Losing Sleep

By Victoria Gonzalez / Dec 29, 2025

How I Read the Market’s Mood for Smarter Wealth Growth

By Natalie Campbell / Dec 29, 2025